Los Angeles Tax Calculator

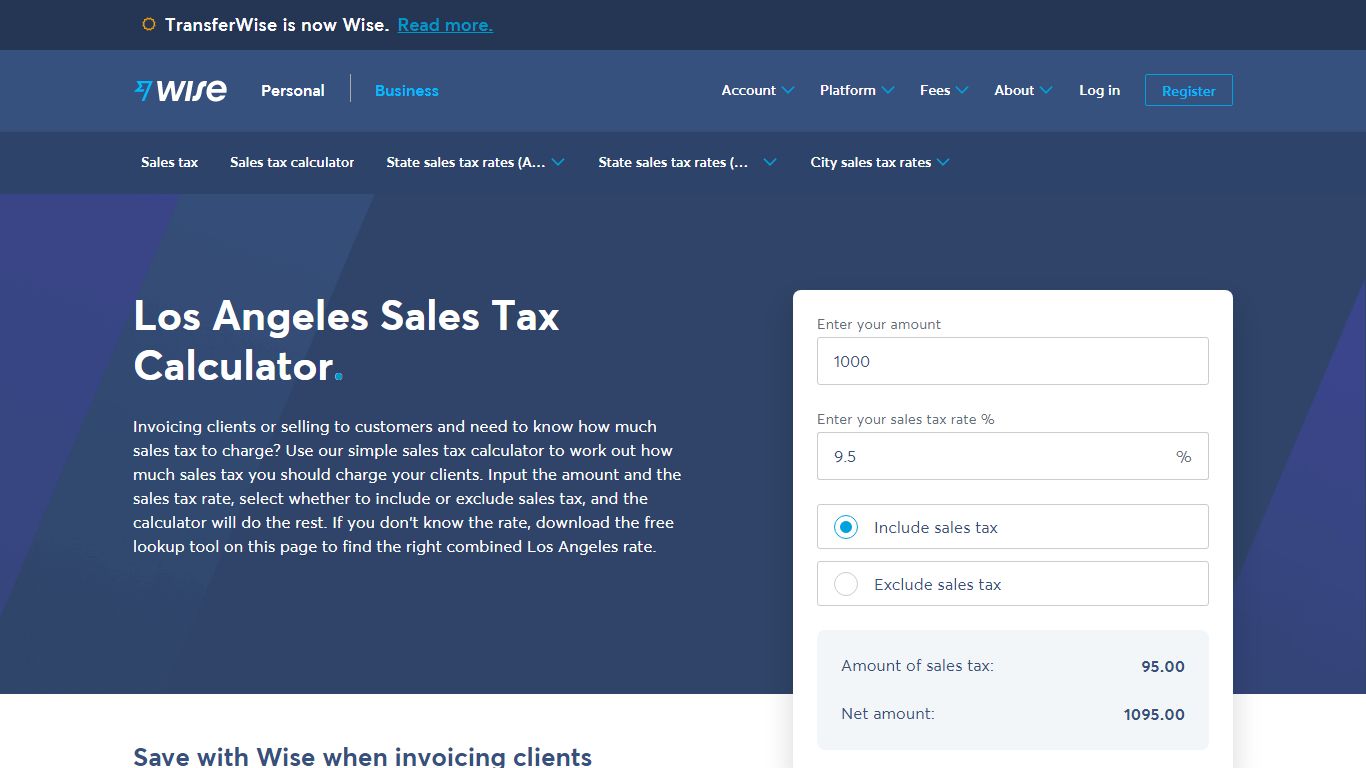

Los Angeles Sales Tax Rate and Calculator 2021 - Wise

To calculate the amount of sales tax to charge in Los Angeles, use this simple formula: Sales tax = total amount of sale x sales tax rate (in this case 9.5%).

https://wise.com/us/business/sales-tax/california/los-angeles

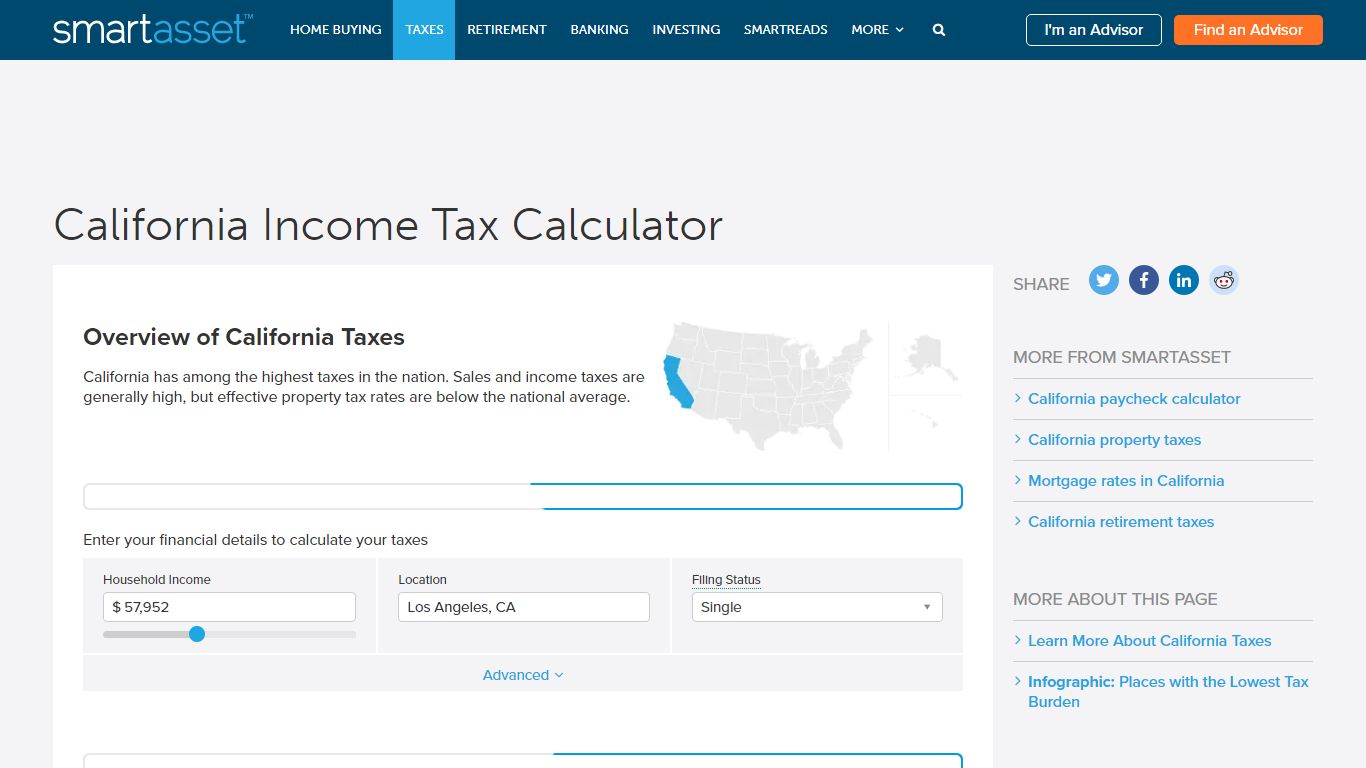

California Income Tax Calculator - SmartAsset

Our income tax calculator calculates your federal, state and local taxes based on several key inputs: your household income, location, filing status and number of personal exemptions. Also, we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. How Income Taxes Are Calculated

https://smartasset.com/taxes/california-tax-calculator

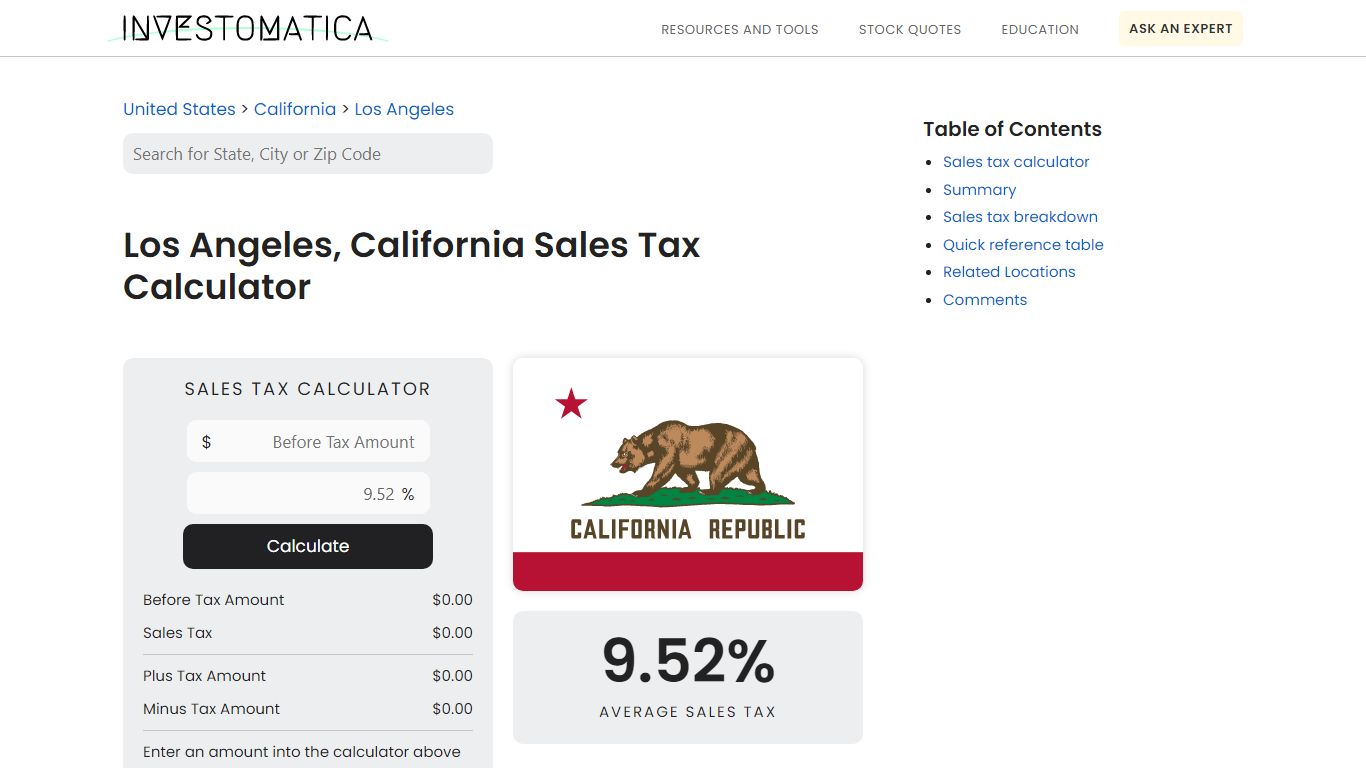

Los Angeles, California Sales Tax Calculator - Investomatica

Enter an amount into the calculator above to find out how what kind of sales tax you'll see in Los Angeles, California. You'll then get results that can help provide you a better idea of what to expect. 9.52% Average Sales Tax Summary The average cumulative sales tax rate in Los Angeles, California is 9.52%.

https://investomatica.com/sales-tax/united-states/california/los-angeles

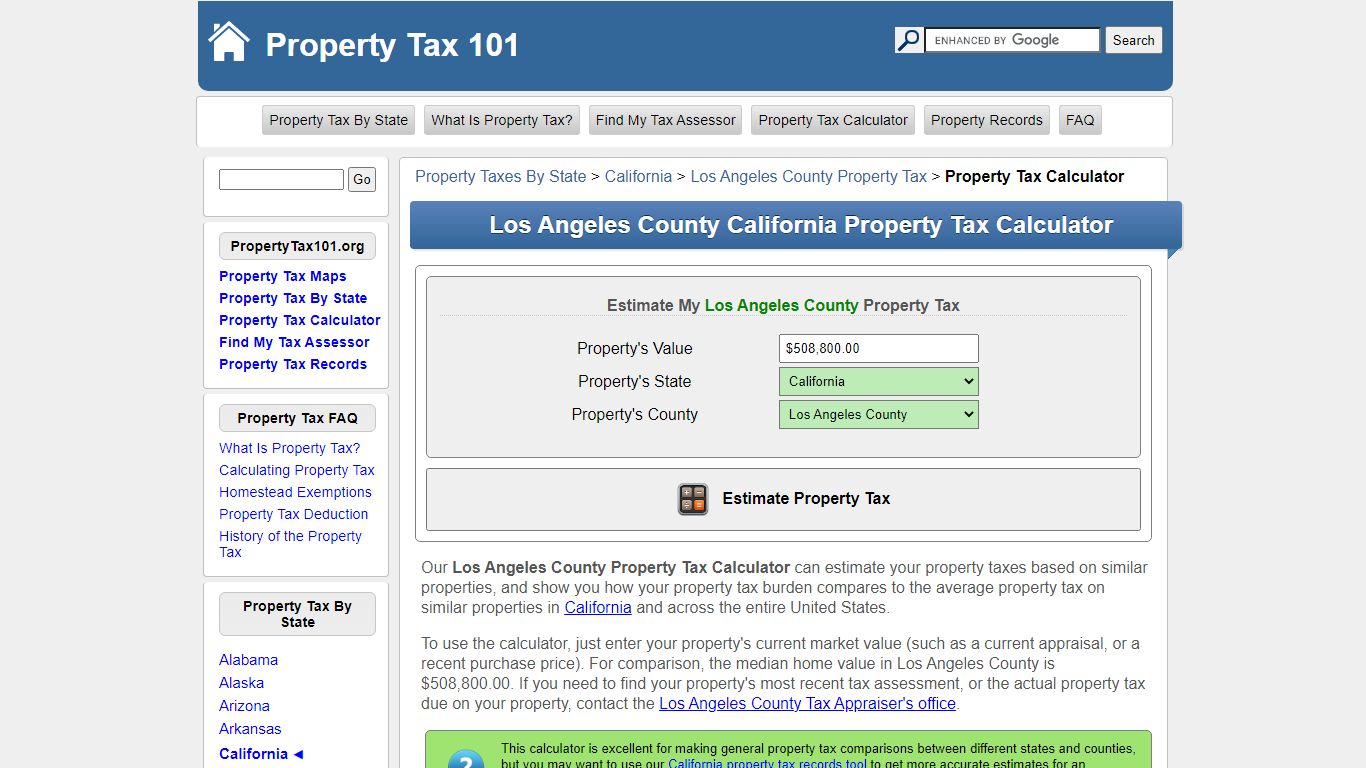

Los Angeles County California Property Tax Calculator

Our Los Angeles County Property Tax Calculator can estimate your property taxes based on similar properties, and show you how your property tax burden compares to the average property tax on similar properties in California and across the entire United States.

https://www.propertytax101.org/california/losangelescounty/taxcalculator

Business Tax Calculator (BETA) | Los Angeles Office of Finance

The Business Tax Calculator is part of a suite of self-assessment tools created by the Office of Finance to help business owners and entrepreneurs plan for their businesses by estimating their City taxes due. To use the calculator: + Select your business category from the first drop down field; and, + Input your gross receipts in the second field

https://finance.lacity.org/business-support-tools/business-tax-calculator-beta

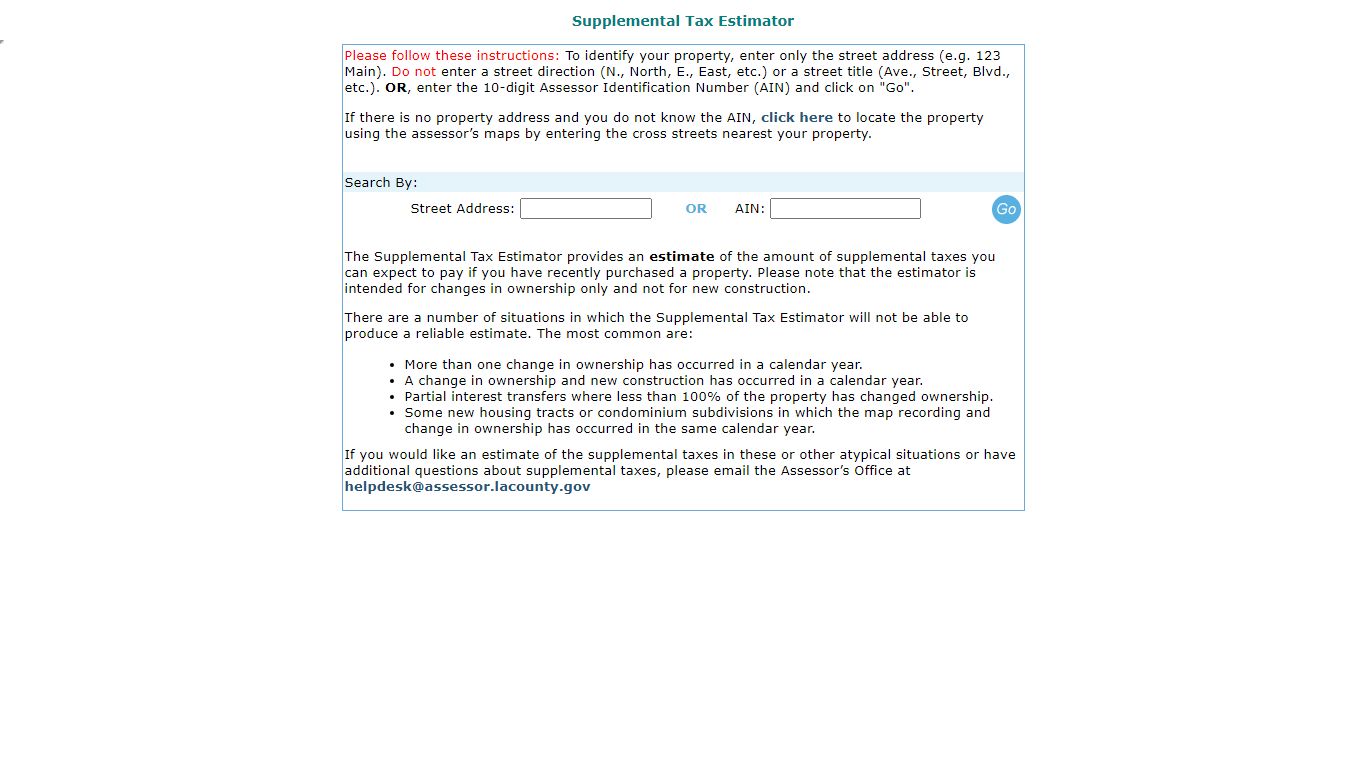

Assessor - Supplemental Tax Estimator - Los Angeles County, California

Supplemental Tax Estimator Please follow these instructions: To identify your property, enter only the street address (e.g. 123 Main). Do not enter a street direction (N., North, E., East, etc.) or a street title (Ave., Street, Blvd., etc.). OR, enter the 10-digit Assessor Identification Number (AIN) and click on "Go".

https://assessor.lacounty.gov/homeowners/supplemental-tax-estimator

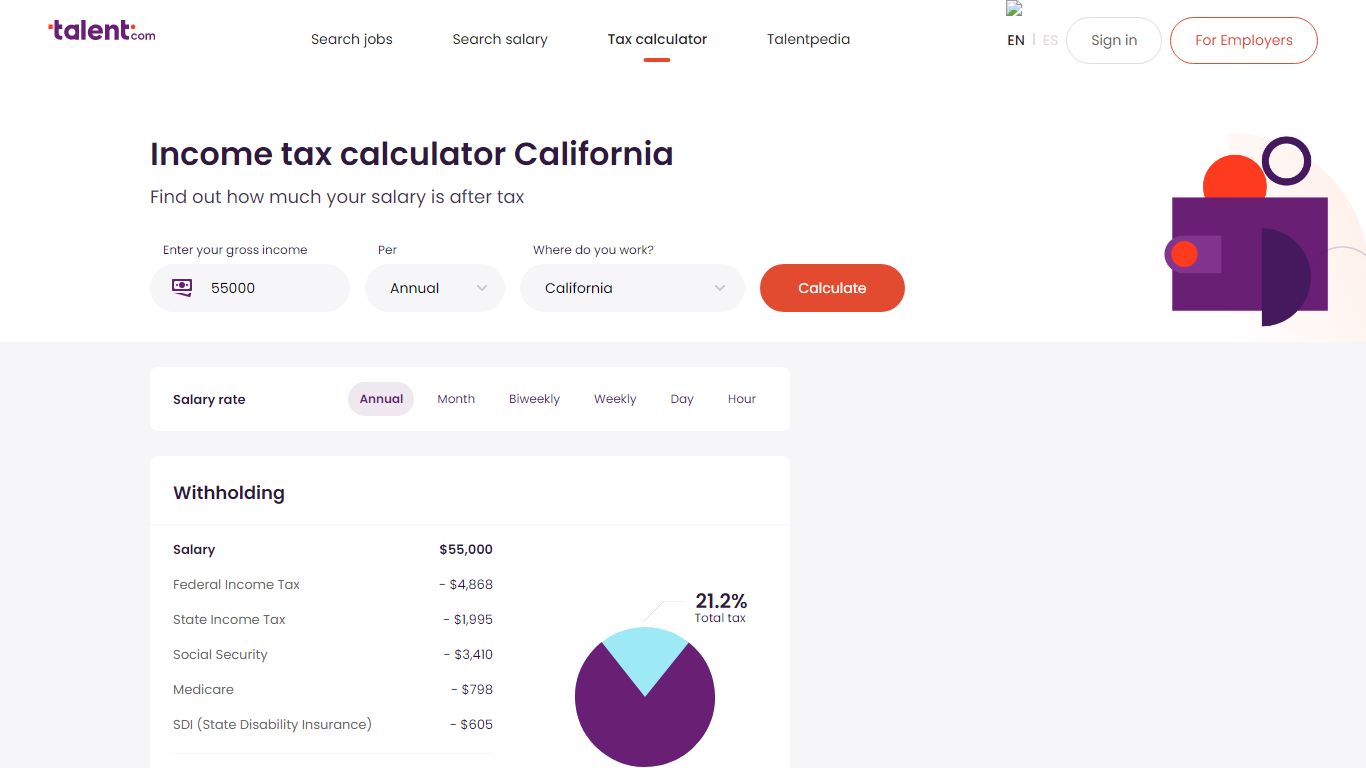

Income tax calculator 2022 - California - salary after tax - Talent.com

If you make $55,000 a year living in the region of California, USA, you will be taxed $11,676. That means that your net pay will be $43,324 per year, or $3,610 per month. Your average tax rate is 21.2% and your marginal tax rate is 39.6%. This marginal tax rate means that your immediate additional income will be taxed at this rate.

https://www.talent.com/tax-calculator/California

Supplemental Tax Estimator - Los Angeles County, California

Supplemental Tax Estimator Please follow these instructions: To identify your property, enter only the street address (e.g. 123 Main). Do not enter a street direction (N., North, E., East, etc.) or a street title (Ave., Street, Blvd., etc.). OR, enter the 10-digit Assessor Identification Number (AIN) and click on "Go".

https://assessorapp.lacounty.gov/supptaxcalc.aspx

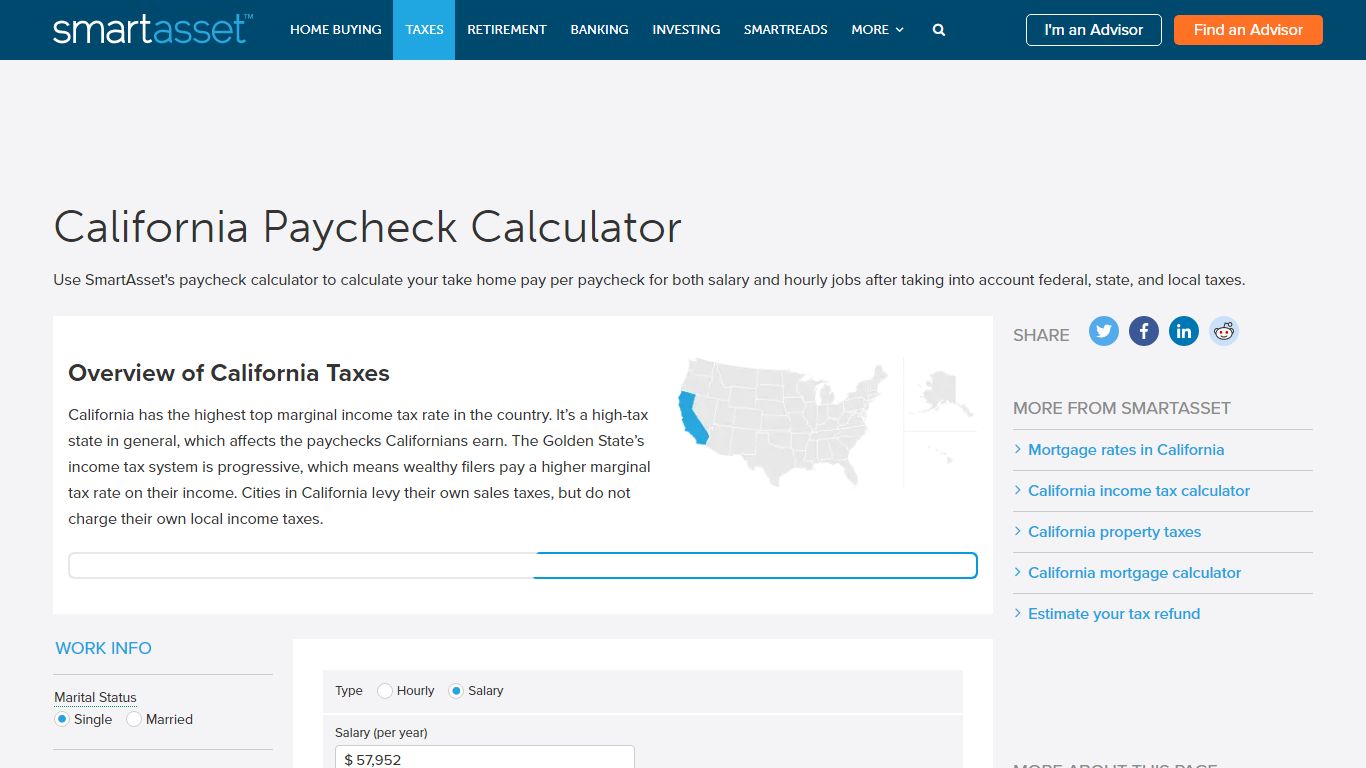

California Paycheck Calculator - SmartAsset

Your employer withholds a 6.2% Social Security tax and a 1.45% Medicare tax from your earnings after each pay period. If you earn over $200,000, you’ll also pay a 0.9% Medicare surtax. Your employer matches the 6.2% Social Security tax and the 1.45% Medicare tax in order to make up the full FICA taxes requirements.

https://smartasset.com/taxes/california-paycheck-calculator

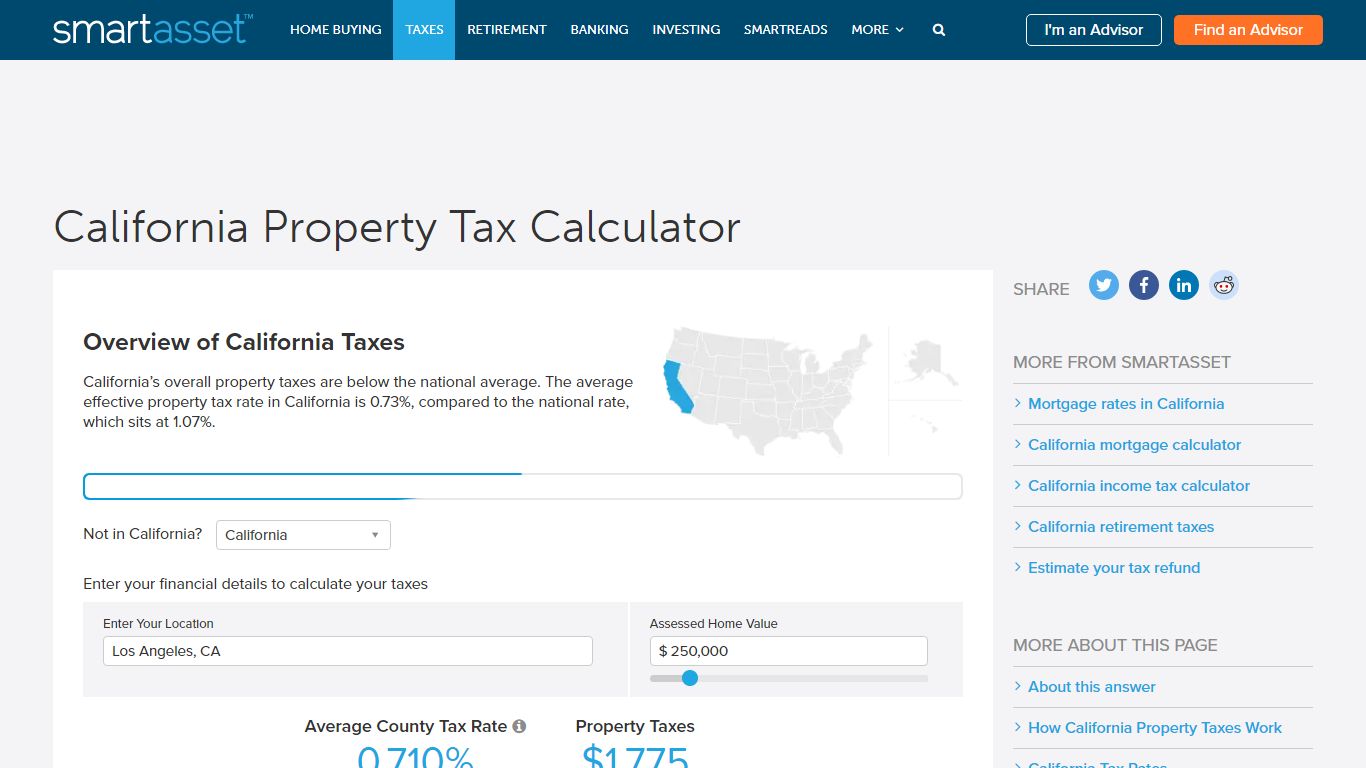

California Property Tax Calculator - SmartAsset

To calculate the exact amount of property tax you will owe requires your property's assessed value and the property tax rates based on your property's address. Please note that we can only estimate your property tax based on median property taxes in your area. ... Los Angeles County: $543,400: $3,938: 0.72%: Madera County: $235,200: $1,786: 0 ...

https://smartasset.com/taxes/california-property-tax-calculator

Los Angeles County California Property Taxes - 2022 - Tax-Rates.org

The median property tax in Los Angeles County, California is $2,989 per year for a home worth the median value of $508,800. Los Angeles County collects, on average, 0.59% of a property's assessed fair market value as property tax.

https://www.tax-rates.org/california/los_angeles%20county_property_tax